|

External Newsletter January 2024 - N° 154

|

|

|

|

EDITO

For the4th year running, BADGE is France Angels' leading network

|

|

|

|

Dear Business Angels friends, dear readers,

With the final closing operations completed in December, we are now in a position to take stock of the past year.

I'm proud to announce that, for the fourth year running since 2020, BADGE has distinguished itself by occupying first place in terms of the amount of funding granted to startups.

Our members contributed €4.4 million to 28 companies, including 13 first-round investors. These companies raised over €2.5M in financing, up 10% on the previous year. Over €20M has been invested in innovation in five years, contributing to the country's economic recovery, since almost all of this has been invested in companies headquartered in France.

The year 2024 is shaping up well, with two closings expected in January and other projects in the pipeline.

The other good news comes from the 2024 Finance Law. Throughout last year business angels worked under the coordination of France Angels with Essonne MP Paul Midy to enlighten him on the measures he proposed to the government to encourage risk-taking through investment in innovation. This initiative was crowned with success as these measures were adopted in the 2024 Finance Law.

I'll summarize those of particular relevance to us as risk investors: the Young Innovative Company (JEI) status is granted to companies whose R&D expenditure exceeds 15% of their costs. Investment in these companies is eligible for a 30% tax reduction, up to a maximum investment of €150,000 over 5 years per tax household (2 people). An expanded status of "JEI et Croissance" has been created for JEI companies whose R&D expenditure is between 5% and 15%, and which meet a growth capacity criterion. This status gives access to the same rights.

A JEI and Rupture status has also been created for JEIs that devote more than 30% of their costs to R&D. This higher-risk status entitles companies to a 50% tax reduction on investments of up to €100,000 per tax household. As a result, it will be possible to benefit from an additional €50,000 in tax reductions over 5 years, while maintaining the status of IR PME, which offers an 18% tax reduction within the €10,000 annual limit for "tax niches". Other measures to help with cash flow and access to public procurement will provide direct support for start-ups over the next five years. France Angels is organizing a webinar on January 24 from 12pm to 1:15pm to explain these measures in detail, so stay informed and register by clicking here.

I wish everyone a very happy 2024, and hope that the drive to support innovation will bear fruit, with more start-ups becoming scale-ups and, in some cases, unicorns.

Best regards,

Paul Leondaridis,

Chairman of Business Angels des Grandes Écoles.

|

|

|

|

|

|

INTERVIEW

Charlotte Gazeau, a business angel

in the service of impact

|

|

|

|

|

|

1) Can you tell us about your background?

In my professional career, I have alternated between experience in innovative companies (start-ups, scale-ups) and consulting. Today, as Sustainable Development Manager with In Extenso Innovation Croissance, I work with entrepreneurs and managers on innovative impact projects or transformation projects for the transition: impact review and formulation of an impact thesis as part of fund-raising, development of a CSR strategy and construction of associated roadmaps, changes in modes of governance (company with a mission), CSR progress approach thanks to certifications (e.g. Lucie 26.000, B Corp...), improving circularity on products etc...

2) Can you tell us about your involvement with BADGE?

Passionate about innovation and entrepreneurship, I joined BADGE in 2020. In particular, I'm involved in sourcing start-ups seeking funding and liaising with alumni associations. I'm also a member of the Board of Directors.

3) What is your vision of the impact investment ecosystem?

The need to take impact into account in innovation and its financing is becoming essential as a result of the ecological transition (planetary limits reached for certain resources, climate change, etc.). This evolution of business models must integrate both environmental and social issues.

Impact models are based on four dimensions: ecological impact, social and societal impact, value sharing and power sharing (governance).

For all innovative solutions, especially technological ones, it is becoming increasingly important to assess them in terms of sustainable development, and to identify the externalities of these innovations in order to limit their negative impacts right from the design stage, as well as to optimize their place in their value chain and industry.

Within the ecosystem, innovation funders - both public and private - are increasingly including impact assessment as a condition of funding. Some investment funds are also dedicated to impact (article 8, article 9), with selection criteria and specific monitoring and reporting for their holdings.

Increasingly, the notion of extra-financial performance will be expected of companies from a regulatory point of view.

Many startups are focusing on the necessary transition, with innovative solutions enabling adaptation to climate change (cleantech, greentech, tech for good, etc.) or addressing social and societal issues (education, health, the elderly, etc.).

More generally, many entrepreneurs, whatever their solution and business model, are today very committed to CSR (corporate social responsibility) aspects and their relations with their stakeholders. They may be mission-driven companies or seek out labels such as Lucie 26.000 or B Corp to demonstrate this ambition. Highly committed, they are also looking for financiers aligned with their values.

4) How is BADGE evolving to increasingly integrate this impact dimension?

Thanks to its history and its expert members, BADGE has been selecting greentech and cleantech in particular for a long time, focusing on the energy transition or the transition to mobility, for example.

BADGE plays an active role in financing impact start-ups: 11 of the start-ups it has financed are included in France digitale's mapping of impact start-ups in 2023.

Beyond their interest in disruptive projects providing transitional solutions, BADGE members are increasingly interested in investing in projects that make sense.

The evaluation of start-ups of all types entering the dealflow will evolve by integrating more evaluation criteria on externalities and impact.

According to data from the In Extenso Innovation Croissance Fundraising Barometer (available in the "Useful Information" section of this newsletter), ESSEC Business School and France Angels, the investment sector was marked by a number of salient events last year:

In 2023, the French Tech sector raised 9 billion euros, down 34% on 2022. Despite this decrease, the cumulative amount is almost double the pre-pandemic level of 5 billion euros, testifying to the resilience and dynamism of French start-ups.

At European level, Tech raised €51.6 billion in 2023, down 28% on the previous year. There was an 11% increase in the number of deals in France and a 14% increase in Europe compared to 2022.

The year was also marked by heightened selectivity on the part of investors in France, with a shift towards start-ups in their seed phase (under €1 million), as well as towards certain particularly attractive strategic sectors. The three most sought-after sectors in France were energy, SaaS software and healthcare, while disruptive technologies, particularly in artificial intelligence, were also highly attractive.

Against a backdrop of slowing mega-raises and valuations, France recorded 12 mega-raises of over €100 million, involving companies such as Verkor, Mistral AI, DRIVECO, Ÿnsect, Amolyt Pharma, TSE, énergie de confiance, Poolside, Aledia, Accenta.ai, Ledger, mylight150 and Pasqal. The energy sector is the most attractive in Europe and France. Among these mega-risers are companies focused on energy and ecological transition: Verkor (gigafactories for electric batteries), Driveco (charging stations), TSE (solar), Mylight150 (solar). Transition has a future.

|

|

|

|

|

UPCOMING EVENTS

|

|

|

>>> PROJECT PRESENTATIONS

|

|

Monthly meetings with presentations of innovative fund-raising projects led by Philippe Pernot, Vice-Chairman in charge of project appraisal.

Members only.

Non-members, ask for your invitation .

|

|

|

|

|

Tuesday, January 23, 2024 at 5:30 p.m.

Monthly meeting, Escal consulting, 5 Rue de Téhéran, 75008 Paris and by Zoom.

|

| I request my invitation |

|

|

|

|

Tuesday, February 27, 2024 at 5:30 pm

Monthly meeting, Maison des Polytechniciens - Salon Caroline Aigle, 12, rue de Poitiers - 75007 Paris and by Zoom.

|

| I request my invitation |

|

|

|

|

|

|

|

|

2023 fundraising barometer In Extenso Innovation Croissance, ESSEC Business School and France Angels

|

|

In Extenso Innovation Croissance 's Fundraising Barometer in partnership withESSEC Business School and France Angels for the year 2023 is now available. In 2023, French Tech raised €9 bn, down 34% on the record year of 2022 (€13.6 bn), but almost twice the level recorded before the pandemic (€5 bn), a sign of the resilience and dynamism of French start-ups. Overall, France remains the second European country to raise the most funds in 2023, after Great Britain, but ahead of Germany. To find out more, click here.

|

| Read the press release |

|

|

|

|

|

|

|

|

|

News from our funded startups

|

|

|

|

|

|

|

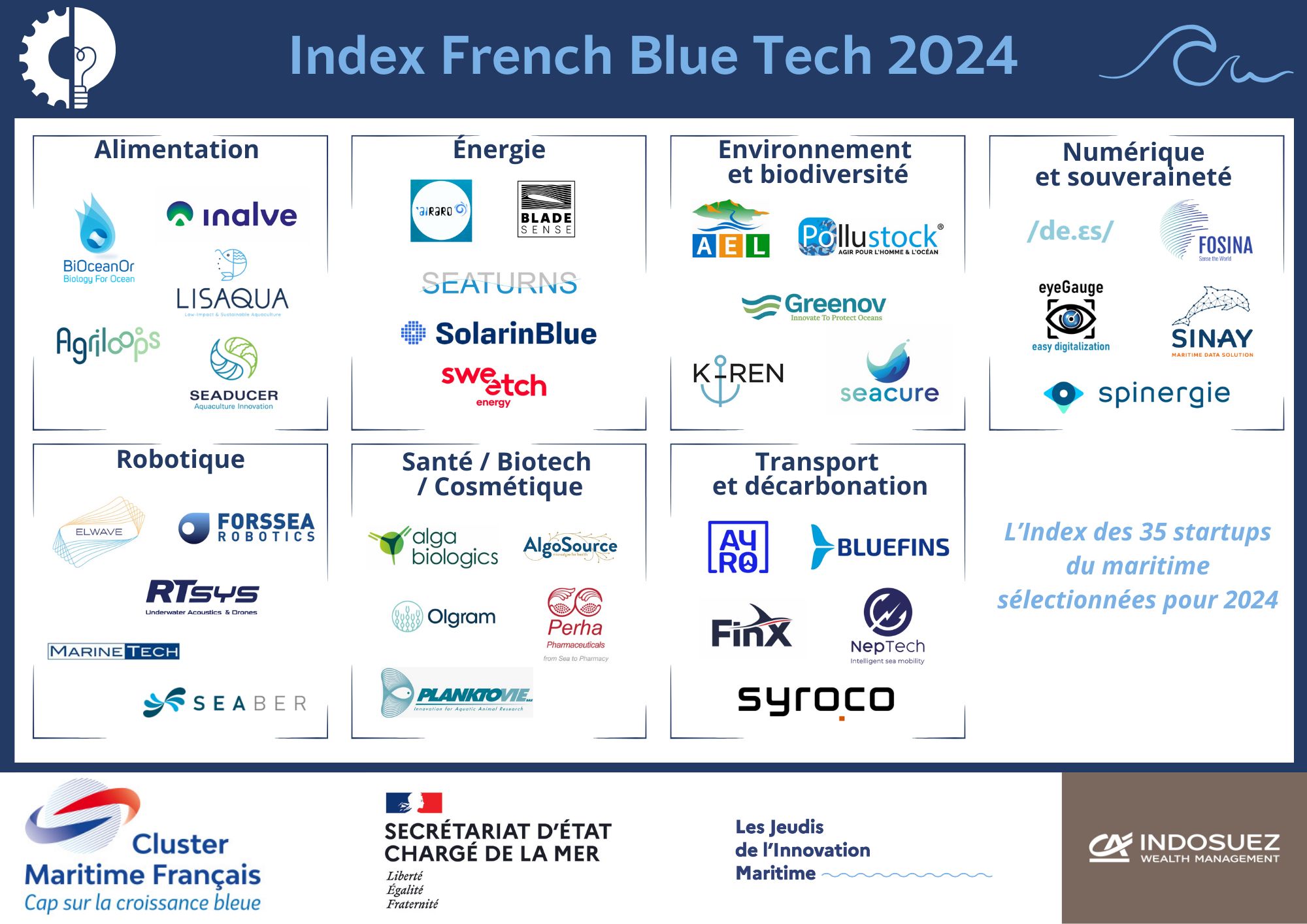

Start-ups EyeGauge and Sinay, winners of the French Blue Tech Index of the best maritime start-ups

|

|

|

|

|

Launched by the French Maritime Cluster (CMF), the French Blue Tech Index is the first index of French start-ups in the maritime sector. Its aim is to promote and support these companies in order to facilitate the channelling of investment and improve support for these young start-ups.

Following a selection process, 35 start-ups were chosen for inclusion in the index. This first promotion was established after examination of the dossiers by a group of key players in the maritime sector and experts from the world of innovation.

Congratulations to Eyegauge and Sinay, two of our portfolio companies, for this award which will contribute to their development.

|

| Read more |

|

|

|

|

|

|

Genexpath start-up wins "Golden Tickets" award

Amgen France and the Biolabs incubator

|

|

|

|

|

To promote the progress of innovative initiatives in France, Amgen, a world leader in the biotechnology sector, launched a call for applications at the end of September 2023 to project leaders around the following two themes: innovative solutions in the fields of cardiovascular and metabolic diseases, oncology, hematology and inflammation; and emerging technology platforms in the fields of R&D and data science (e.g. AI, ...).

This program, designed to support projects linked to the treatment of certain diseases, gives the 2 winners (Genexpath and Raidium) the opportunity to benefit from 1 year's mentoring from Amgen France.

Winners also benefit from exclusive access to BioLabs' top-of-the-range facilities, as well as expert support.

|

|

|

|

|

|

|

|

Our startups are recruiting

|

|

|

|

Rogervoice is the start-up that enables deaf and hard-of-hearing people to make everyday calls in complete freedom. It uses voice recognition to transcribe calls in real time and visio-interpretation in French Sign Language.The company is looking for a Javascript Engineer (M/F) to join its team.

|

| I'm applying |

|

|

|

|

|

|

|

|

|

Great projects to invest in within our network

|

|

|

|

|

En Carta Diagnostics is a company that develops, produces and markets high-precision paper-based diagnostics. Based on the latest innovations in synthetic biology, 10 years of R&D and 6 patents (Arizona State and Harvard), the start-up's diagnostics technology platform fills the gap between rapid but inaccurate antigenic tests and high-performance but cumbersome molecular diagnostics. The company's first commercial product meets a strong need in a niche market in developed countries: early detection of Lyme disease.

|

|

|

|

|

|

Winalist is a digital platform for selecting, highlighting and booking the best wine-related activities in Europe. Thanks to Winalist, travelers from all over the world can easily book a visit to the cellars of Champagne Veuve Clicquot, a tour of Châteaux Giscours in Bordeaux, a wine workshop in Italy, a tasting in Portugal's Douro Valley or a hot-air balloon flight over the vineyards of Château de Pommard in Burgundy.

|

|

|

|

|

|

Omini offers a portable device for bedside blood testing. Its patented sensor-based technology enables near-patient testing and self-testing, while keeping providers informed every step of the way. Combining multi-sensor blood test strips, a portable connected reader and a clinical and biological data transmission application, this unique technology represents a giant step forward for precision medicine and a powerful catalyst in the transition to preventive care.

|

|

|

|

|

|

SpaceDreams is the architect of spaceports. The company develops ground facilities for launchers. Today, each launcher develops its own resources. A launcher for a launch pad and a launch pad for a launcher, as if each aircraft had its own airport. Start-up is developing the NuPad, the first interoperable, modular and mobile launch pad, and its digital twin, the TwinPad. It cuts the captive link between launchers and launch pads. It cuts investment and operating costs in half, and consolidates customer business.

|

|

|

|

|

|

Founded in 2019, OPUS Aerospace is a French start-up that aims to develop launch solutions dedicated to small satellites to accelerate space exploration. Through STERNE, its range of reusable launchers, it will enable payloads of up to 300 kg to be placed into precise orbit on the desired date. Today, the company is developing its first suborbital rocket, named "Mesange", which will be launched to embark its technologies & its first customers.

|

|

|

|

|

|

|

|

|

|

|

Moovjee Prize: 15th edition

|

|

|

|

|

The Moovjee Grand Prix is aimed at young entrepreneurs :

- Between the ages of 18 and 30 (on the registration closing date of March 6, 2024);

- Have set up their business in France;

- Own at least 20% of the company's capital or shares;

- Hold a corporate mandate or have the authorization of a legal representative and reside in France;

- Have the ambition to grow and create jobs;

- The company's head office and main activity must be located in France.

Entrepreneurs who set up their business after September 1, 2023 can choose to apply in the Entrepreneur or Project Sponsor category. 5 finalists will be invited to pitch to the National Jury.

Endowments

Entrepreneur" category:

- Moovjee Grand Prix: a cash prize of 10,000 euros

- Coup de Coeur du Jury: a cash prize of 5,000 euros

Winners and finalists in the Entrepreneur category win the Moovjee mentoring program: 12 months' support from an experienced entrepreneur mentor. Partners, such as the Office Franco-Québécois pour la Jeunesse, which is supporting the "Premiers pas vers l'Export" special mention, will complete the prize fund by rewarding one or more candidates within the target range of their programs/products.

|

| I am a candidate |

|

|

|

|

>>> EDITORIAL COMMITTEE

Paul Leondaridis, President / Yannis Sahraoui, Managing Director

Dimitri Lionel A.Omgba, Communications Manager [Send your subject to the editor]

|

|

|

|

|